EIA Short Term Energy Outlook January 2019

EIA expects U.S. LNG exports to increase from an estimated 3.0 Bcf/d in 2018 to 5.1 Bcf/d in 2019 and to 6.8 Bcf/d in 2020

Yesterday the U.S. Energy Information Administration

released the first short term energy outlook report for 2019. The report noted

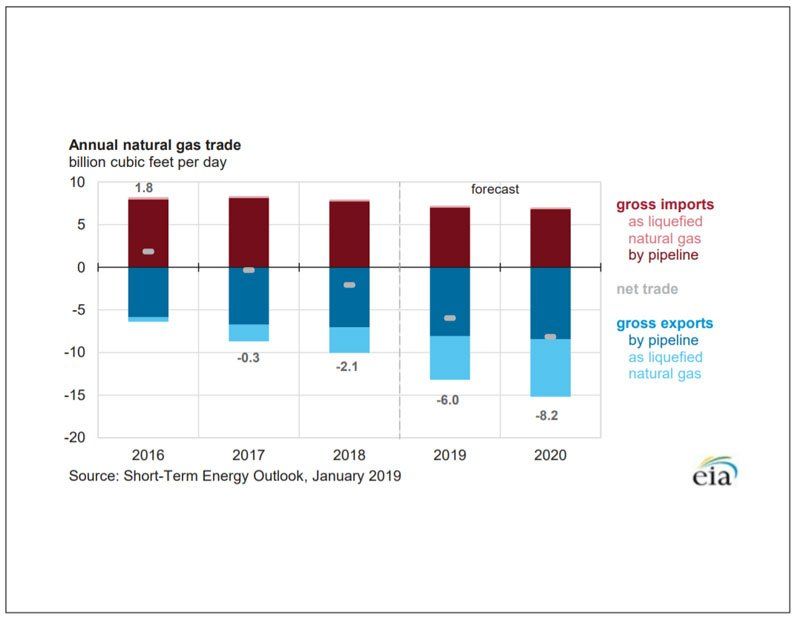

the U.S. exported more natural gas than it imported in 2018, with net exports

averaging 2.1 Bcf/d.

U.S. exports of natural gas, including exports to Mexico and Canada via

pipeline and as LNG, averaged 10.0 Bcf/d in 2018. EIA forecasts that gross U.S

exports will rise by 31.5% to 13.2 Bcf/d in 2019 and then by 15.1% to 15.2

Bcf/d in 2020.

EIA expects U.S. LNG exports to increase from an estimated 3.0 Bcf/d in 2018 to 5.1 Bcf/d in 2019 and to 6.8 Bcf/d in 2020, as three new liquefaction projects come online. EIA forecasts U.S. LNG export capacity will almost double by the end of 2019 to 8.9 Bcf/d once new trains at Cameron LNG, Freeport LNG, and Elba Island LNG are commissioned, making U.S. LNG export capacity the third largest in the world behind Australia and Qatar. By mid-2020, EIA expects U.S. LNG export capacity to reach 9.6 Bcf/d once the third train at Freeport LNG comes online and to expand to 10.2 Bcf/d by mid-2020 once the third train at Corpus Christi LNG comes online.

U.S. natural gas exports to Mexico via pipeline have also

increased as more infrastructure has been built to transport natural gas both

to and within Mexico. U.S. pipeline exports to Mexico through October averaged

4.6 Bcf/d, increasing by 10% in 2018 compared with the same period in 2017. Exports

to Mexico should to continue to increase as more natural gas-fired power plants

come online in Mexico and more pipeline infrastructure within Mexico is built according to the EIA report.

EIA noted U.S. net natural gas pipeline imports from Canada decreased from 2017 to 2018.

This decrease in net imports is expected to continue as Appalachian production

growth displaces some Canadian natural gas imports in the U.S. Midwest markets.

Receive the most important LNG headlines in your email inbox each business day. Just sign up for our FREE LNG Headline Daily Newsletter.

Sign Up Here.